[ad_1]

In a recent post, we explored private B2B SaaS company spending benchmarks. That analysis revealed a difference in spending patterns based on how a company was funded. For example, bootstrapped companies are spending less (and are profitable), while equity-backed companies are operating at a loss to support a goal such as growth. The most dramatic differences include equity-backed companies spending approximately 44% more on marketing, 61% more on R & D, and 70% more on general and administrative costs while spending 100% more on sales.

A common metric by which SaaS companies track their performance is annual recurring revenue (ARR) per employee. As was the case with the last post, the data and analysis below on ARR per employee comes from our 11th annual survey of more than 1,500 SaaS companies, which was completed in March.

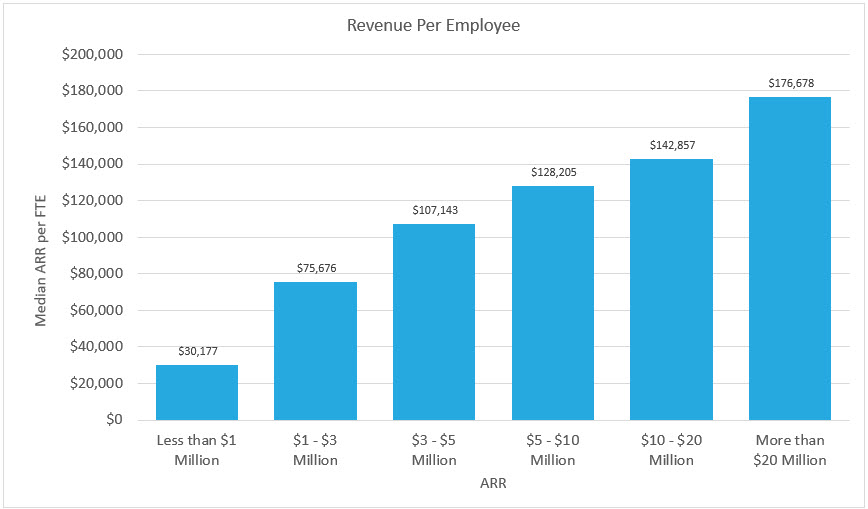

2022 Median ARR per Full-Time Equivalent (FTE) by Company Size

The chart below shows the median ARR per employee broken down by company size. For example, the chart shows that companies with $1 million to $3 million in ARR have a median ARR per employee of $75,676.

The clear takeaway from this chart is that revenue per employee grows as company size increases, clearly demonstrating the scalability of the SaaS business model

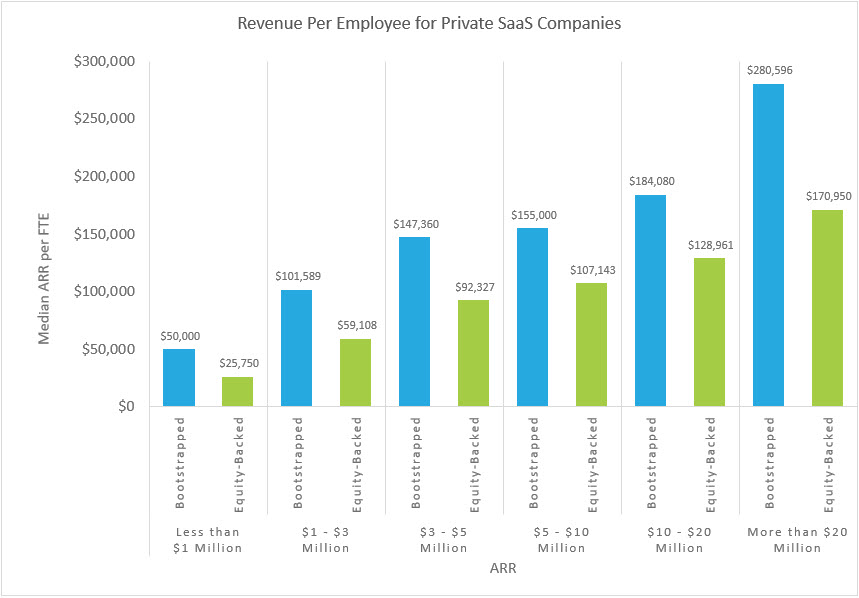

2022 Median ARR per Full-Time Equivalent (FTE) by Funding Type

The chart below shows the median ARR per employee broken down by company size and funding type, equity-backed or bootstrapped. For example, the chart shows that equity-backed companies with $1 million to $3 million in ARR have a median ARR per employee of $59,108. Meanwhile, bootstrapped companies of the same size show a median ARR per full-time equivalent (FTE) of $101,589.

Similar to the first graph, revenue per employee grows as company size increases for both equity-backed companies and bootstrapped companies. The key takeaway is that bootstrapped companies show higher revenue per employee than equity-backed companies at every company size. That said, the lower ARR per employee is not a complete indictment on raising equity. From our research on growth rates, we know that venture-backed companies are generally growing faster than bootstrapped companies.

Note: A version of this post was first published in 2020, and this was updated in 2022 to reflect current data.

![]()

[ad_2]

Source link